AI is reshaping how investment analysts work, but most “AI for finance” content is either too abstract or too promotional to be useful. This post shares the first 15 real examples from 50 Real Examples of How to Use AI in Equity Research and Daily Life—a newsletter featuring practical, actionable workflows investors actually use.

From extracting guidance to redlining 10-Ks to identifying accounting changes in seconds, these examples highlight where AI delivers immediate value in real day-to-day research, without prompting tricks or guesswork. Get two new AI examples in your inbox each week:

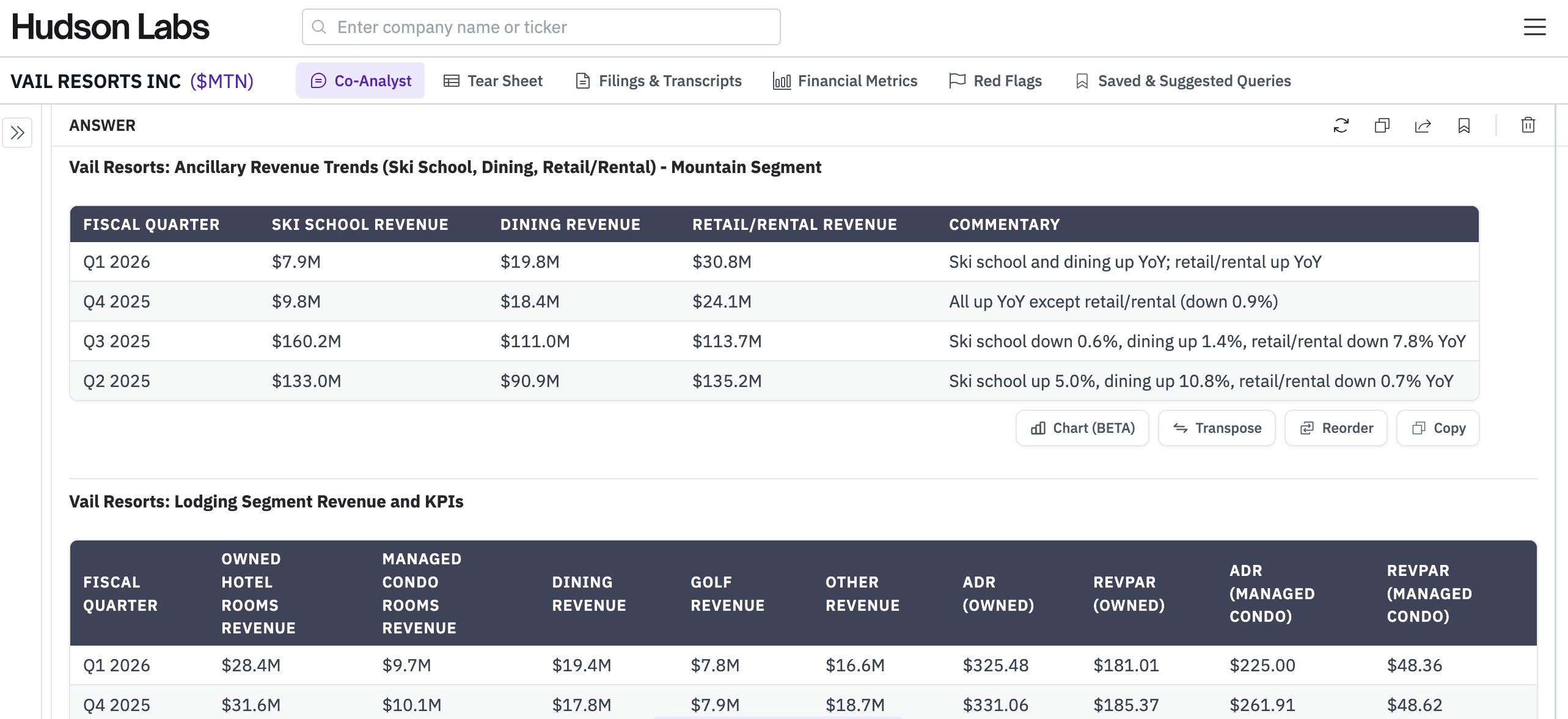

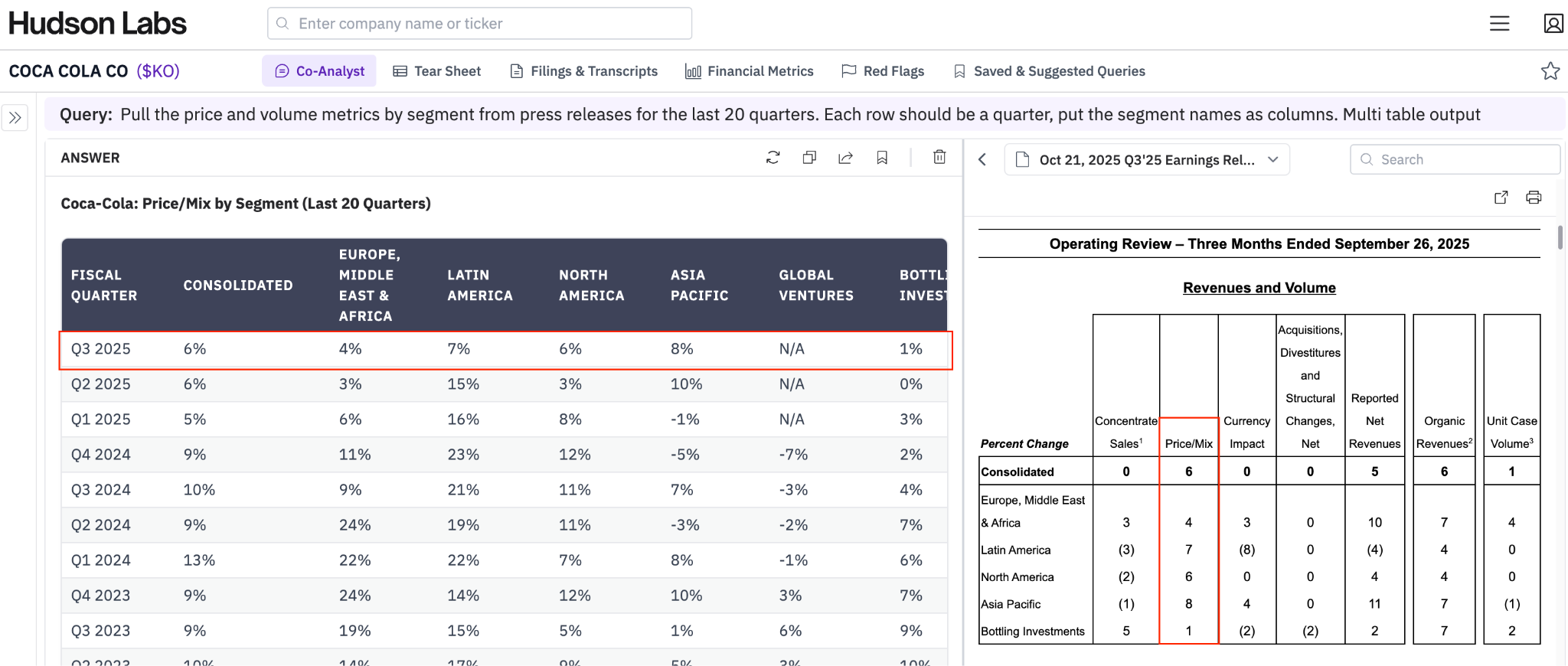

1. Pull hard-to-find operating metric trends in seconds

Find the information you need — direct from source, in any format. You can take information hidden in text, tables, or both, and instantly convert it into a well-structured dataset. Say goodbye to Ctrl + F and copy-paste. Collating segment and product-level trends across multiple years is now as simple as asking.

Hudson Labs has been shown to dramtically outperform competitive tools in high-precision numeric extraction.

Ex 1: Vail Resorts – KPIs by product, segment and geography

View full results and try it yourself here.

Ex 2: Coca-Cola – Price/Mix and Volume by Segment – 5 years

Try it yourself here.

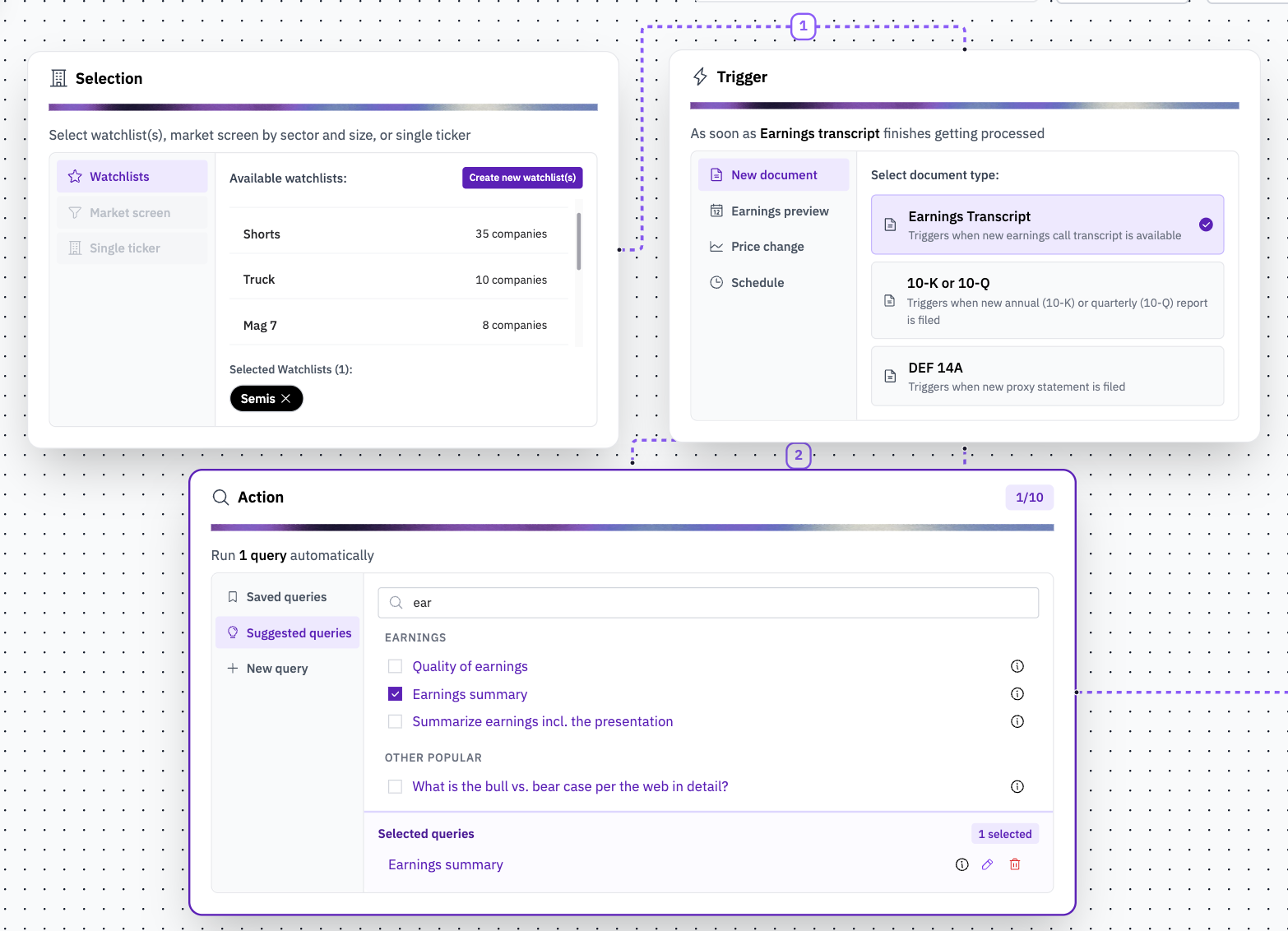

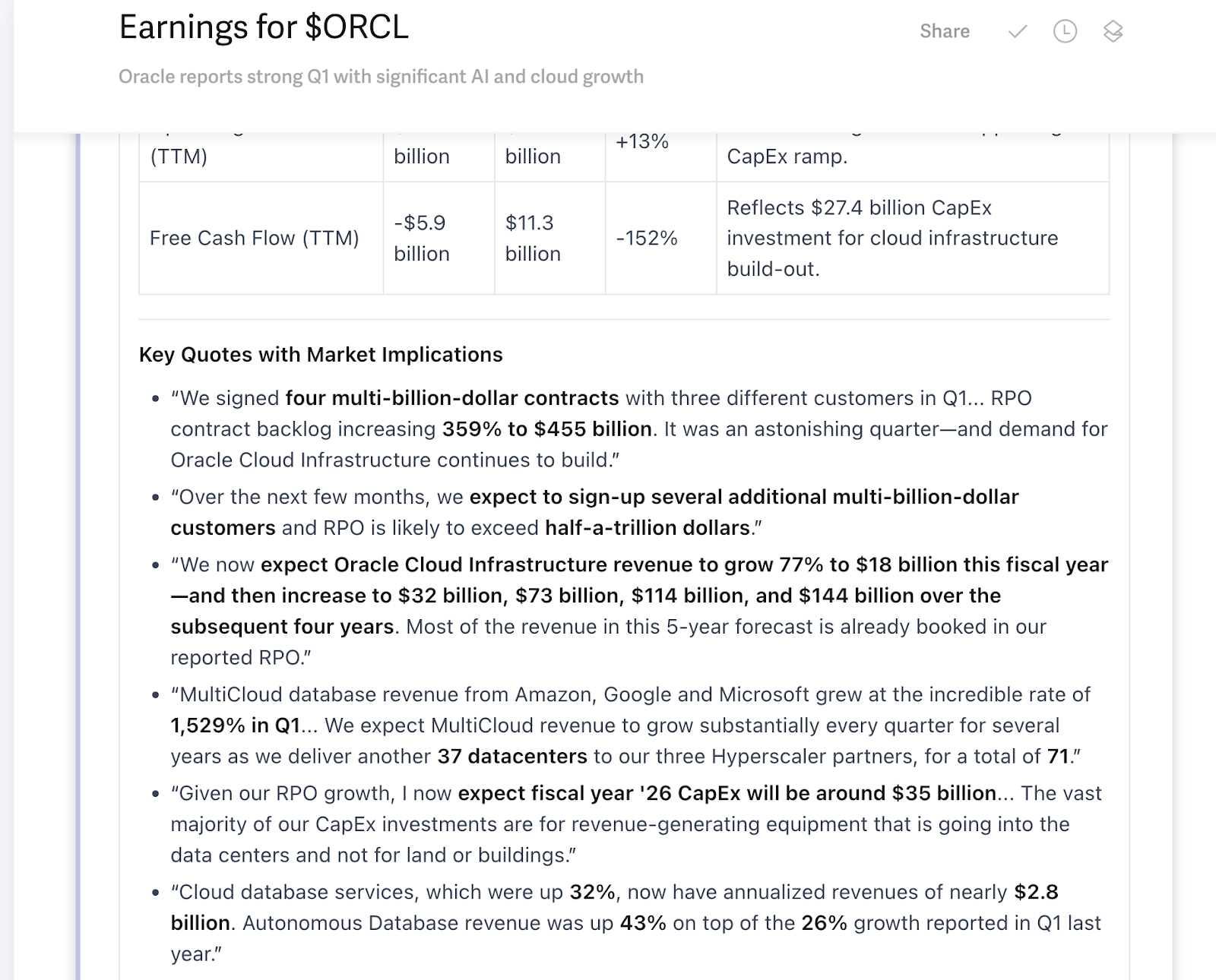

2. Get custom insights, quotes, and earnings summaries straight to your inbox

We’re all familiar with AI earnings summaries — but they can be 10x more valuable with custom queries built for your workflow.

Here are a few ideas to get you going:

• Verbatim macro quotes from bank earnings calls

• Tracking price increases from a supplier watchlist

• Receiving summaries in table or mixed table + bullet formats

• Extracting interim guidance from conference calls five days before earnings

Agentic AI Made Easy: Co-Analyst Automations

Set up your own custom queries and have results delivered directly to your inbox by navigating to the Hudson Labs Automations tab.

Custom email notification example:

3. Find subtle shifts in management sentiment

Catching small changes in how management discusses both strengths and risks can add valuable context to your thesis. Tracking what was said — and how it was said — across quarters used to be tough. With AI, it’s effortless.

Ex: Starbucks – Management Tone, Key Positives and Negatives

Try it yourself here.

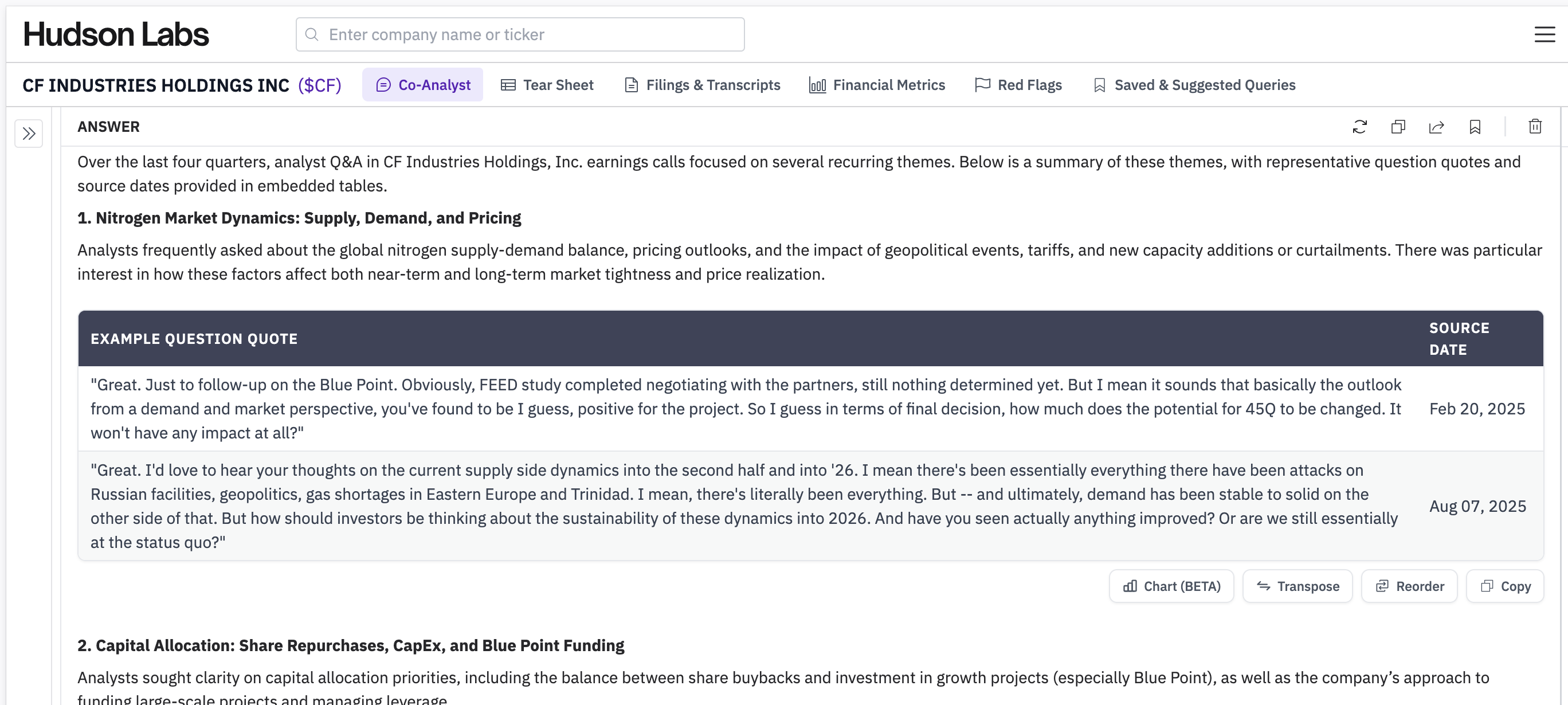

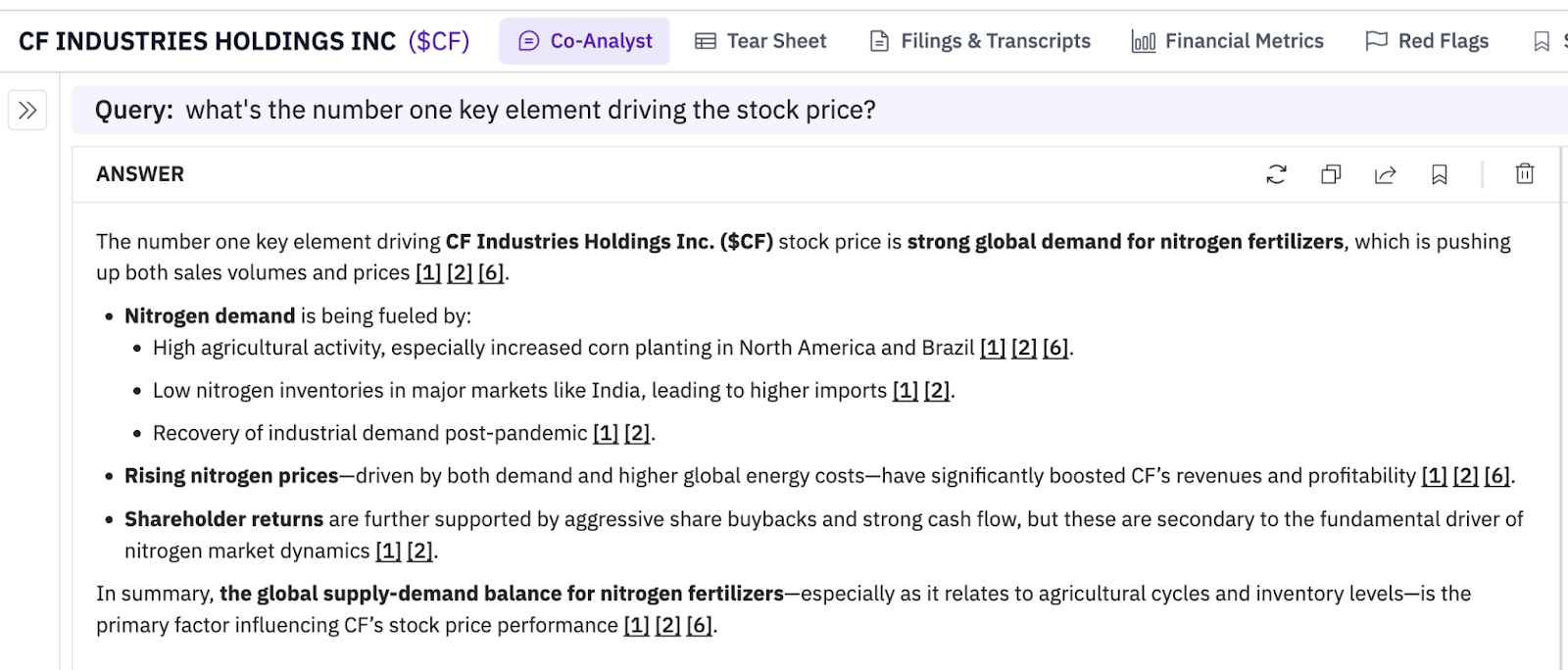

4. Key Debates and Drivers: Understand what's driving the stock price

Understanding the narrative behind a stock — including its key business drivers and ongoing debates — is central to thesis development. While simple in theory, identifying the one or two factors that truly move an unfamiliar stock often requires hours of reading. AI changes that. It can synthesize information across documents and extract themes, cutting this process from hours to minutes.

Ex 1: CF Industries – Themes of sell-side analyst questions

Try it yourself by hitting the re-run button here.

Ex 2: CF Industries – What’s the number one key driver of stock price?

Try it yourself by hitting the re-run button here.

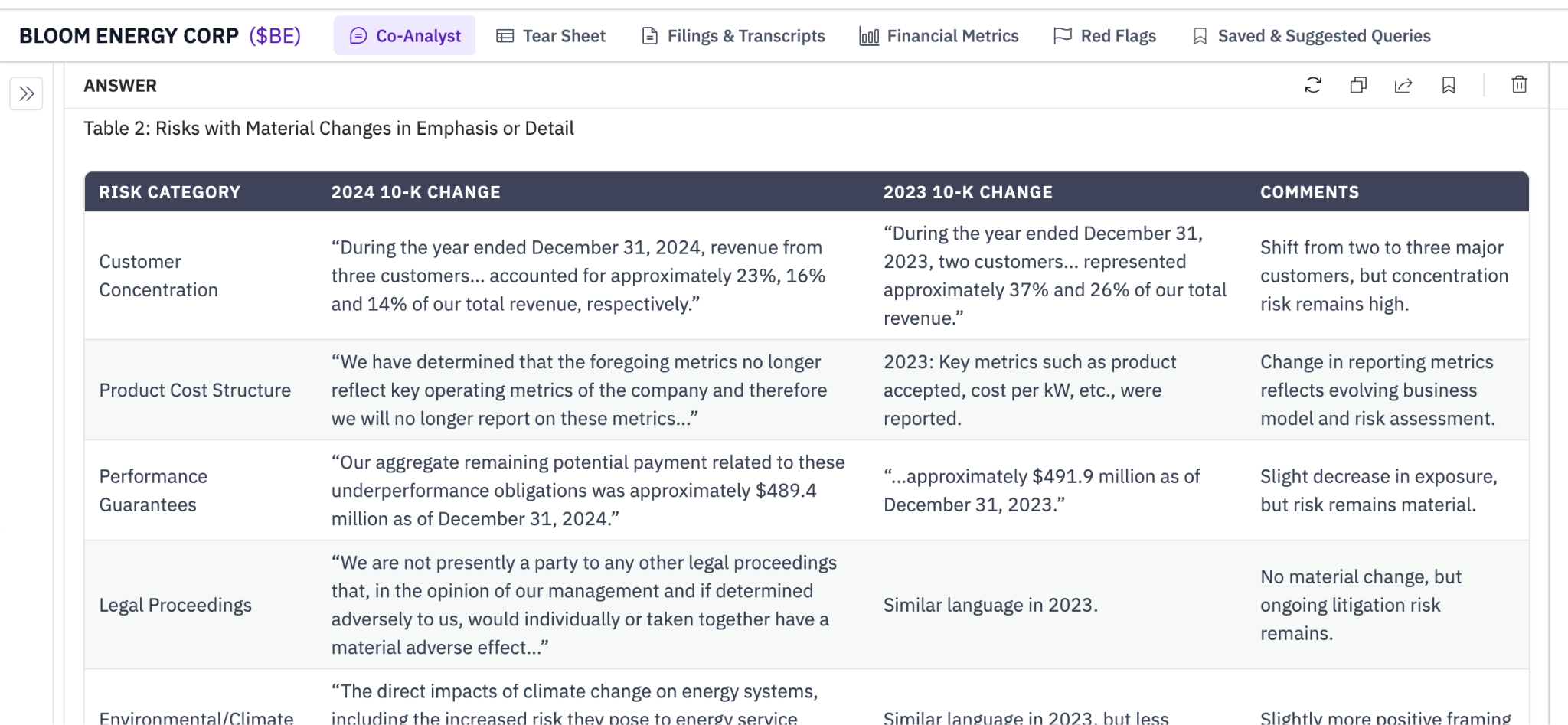

5. Informative 10-K redlines that skip the noise

Many investors use 10-K or 10-Q redlines to spot changes management may prefer you overlook — for example, new risk language. Traditional redlines can be overwhelming because they surface every change, including minor formatting or grammatical edits.

AI now allows investors to assess year-over-year changes in risk disclosure without the noise.

Removing the noise matters. One early finding: companies that update their 10-K risk disclosures more frequently are actually slightly less likely to face SEC enforcement. The content of the changes matters far more than the volume.

Ex: Bloom Energy – Current 10-K risk section vs. prior period

Try it yourself here.

6. Use AI to predict fraud

Forensic analysis is one of the more technical — and less glamorous — areas of equity research. Few people enjoy reading the notes to financial statements, which means even fewer do it rigorously. Most of the time that’s fine; some of the time it isn’t. Avoiding blow-ups can make or break an investor.

AI can help by:

• Predicting fraud

• Making footnote reviews quick and painless

• Explaining forensic concepts and their impact

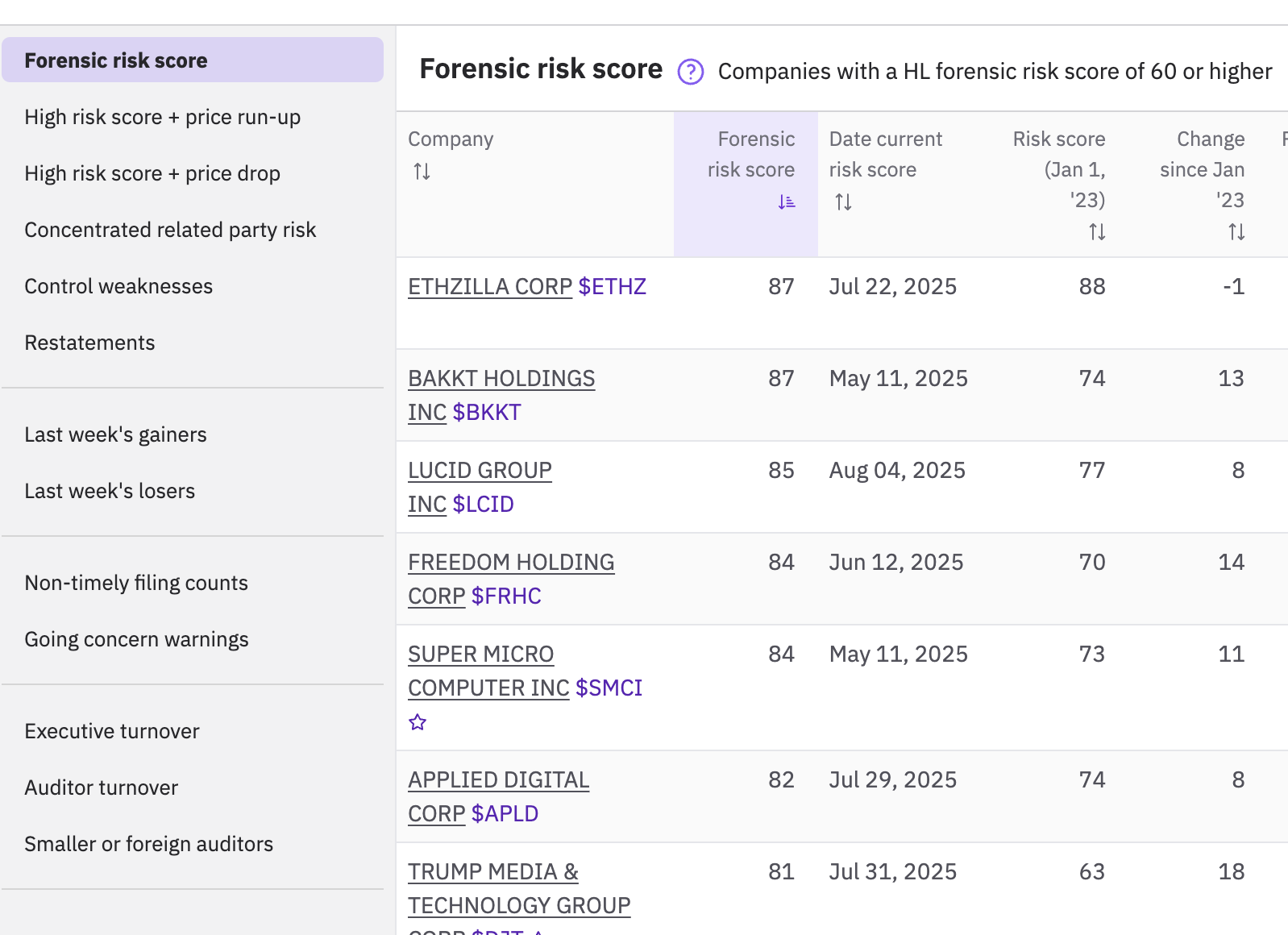

Ex 1: Hudson Labs Risk Scores

The Forensic Score AI model replicates the qualitative elements of the short-selling research process at scale. A score above 70 indicates roughly a 1-in-3 chance of SEC enforcement.

View Hudson Labs Risk Scores here (institutional customers only).

Ex 2: Bloom Energy – Red flag assessment & discovery

Try it yourself here.

Learn more about fraud risk prediction at Hudson Labs:

1. CNBC: Watch our CEO explain the Super Micro Computer scandal and AI's role in discovering.

2. Predicting securities lawsuits: Understand which qualitative factors are most predictive of class action lawsuits related to fraud.

7. Dropped Details: Track decreasing (and increasing) transparency

Management teams are biased toward highlighting good performance and obfuscating the bad. When KPIs get dropped, there’s often a reason. High-precision AI tools can track which specifics are dropped or de-emphasized from one quarter to the next.

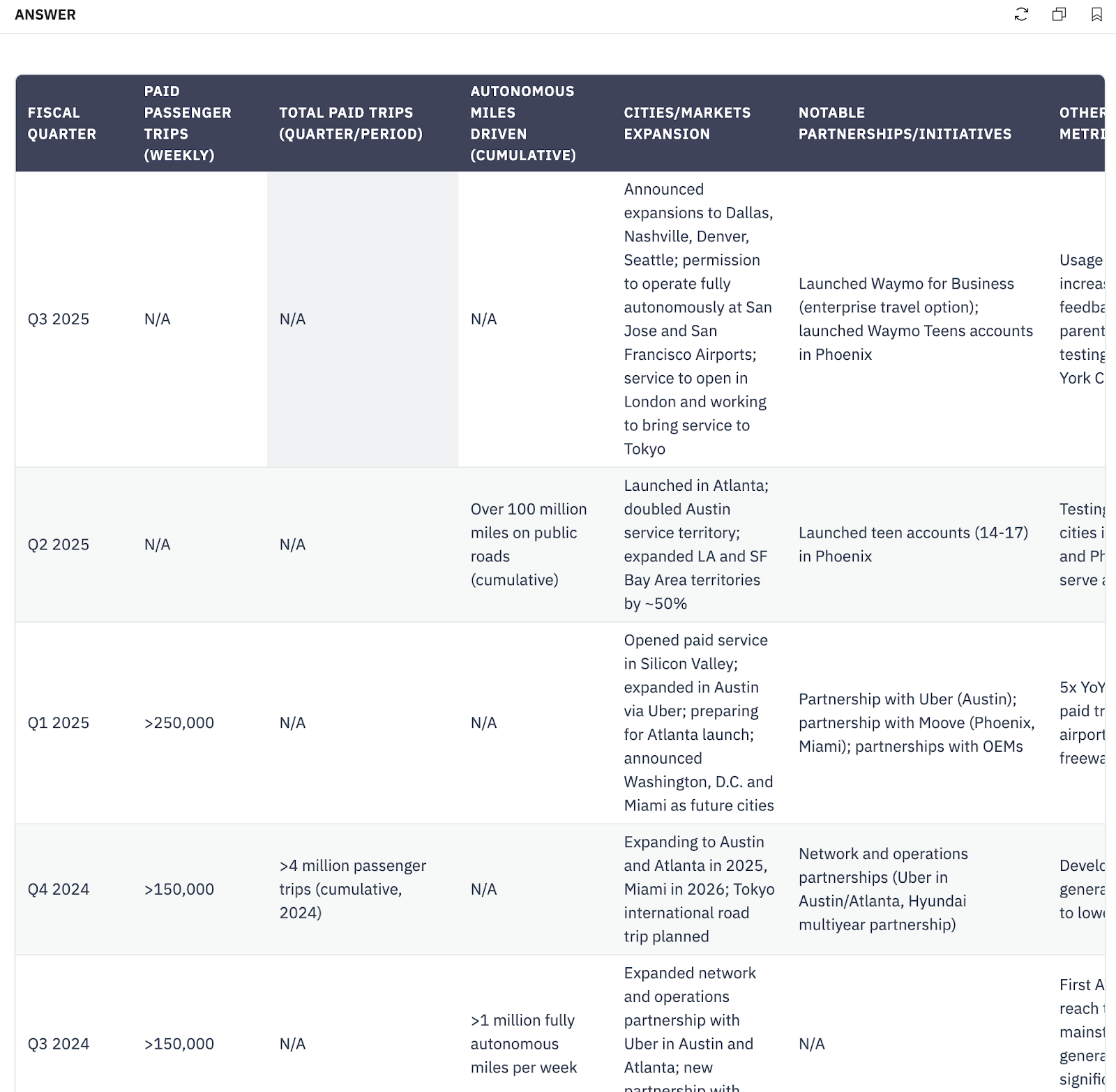

Ex: Alphabet – Evolution of Waymo reporting over 6 quarters

View full results here.

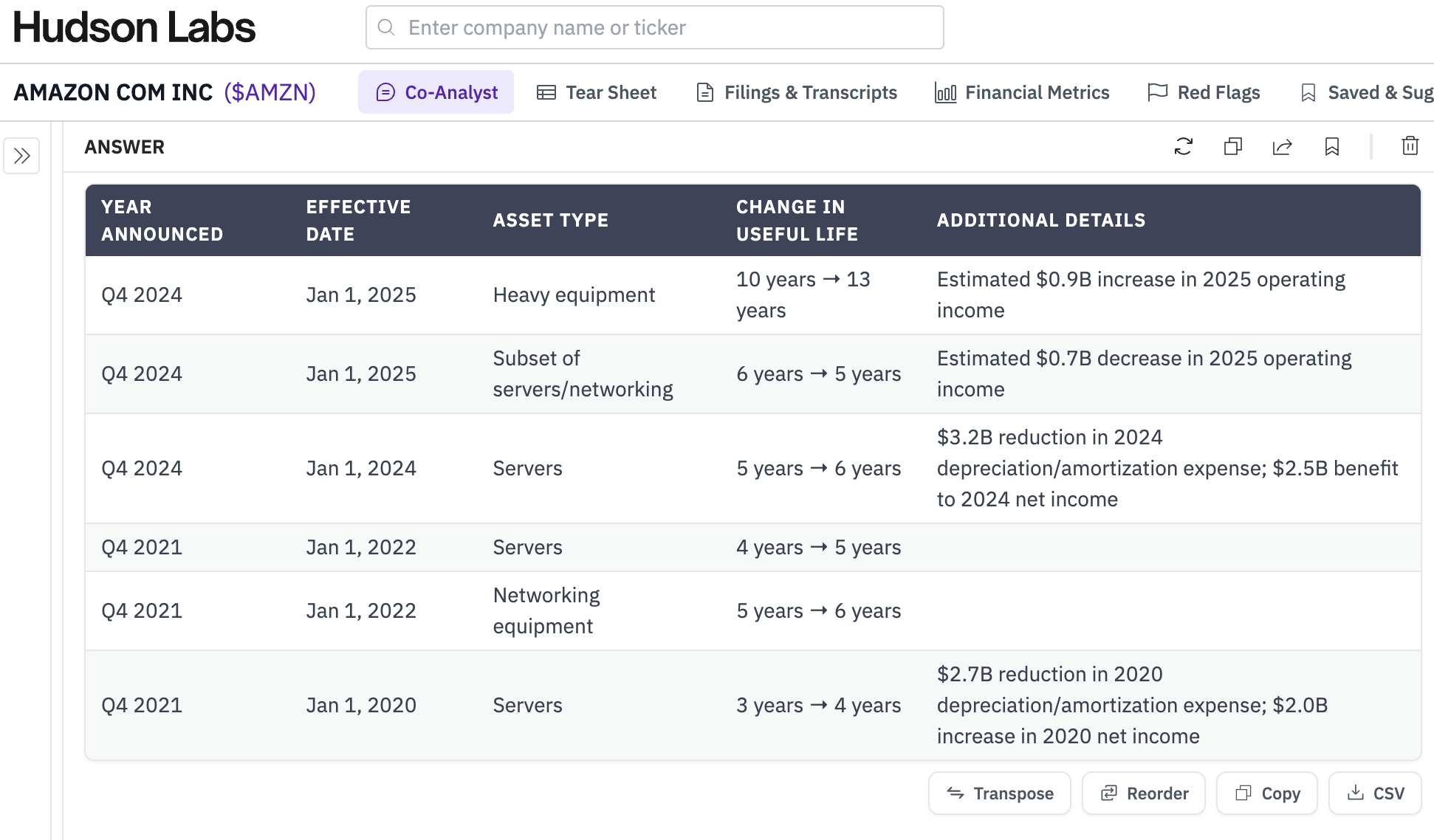

9. Preempt Michael Burry by tracking accounting policy changes

Accounting policy changes help you spot earnings tailwinds or headwinds that are often material but de-emphasized by the market. AI tracks useful life assumptions, revenue-recognition details, capitalization choices, and more — surfacing updates before they move the stock.

Ex 1: Amazon – Useful life estimate changes over time

View the full result and re-run the query here.

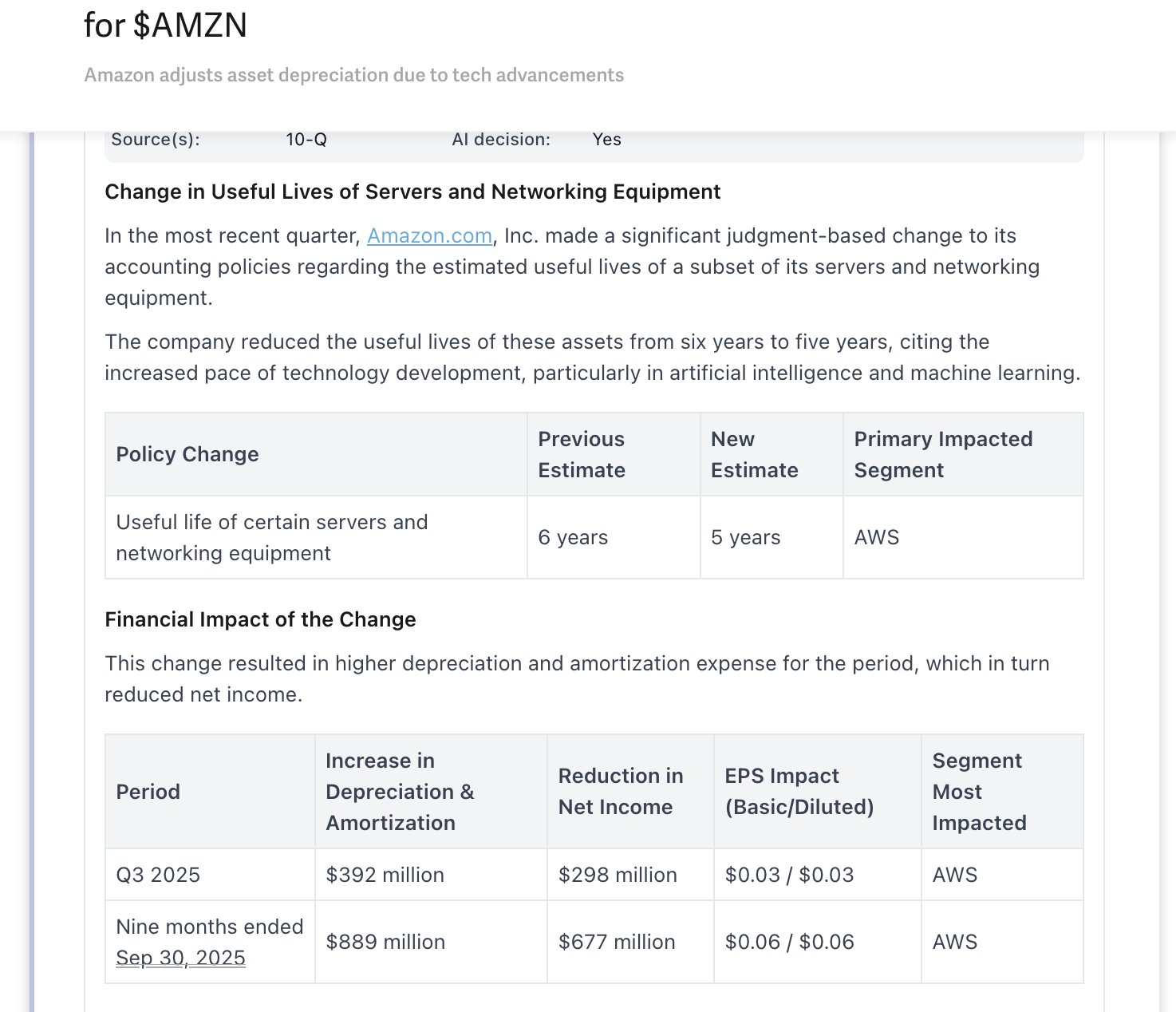

Ex 2: Amazon – Email Alert: Updates to accounting policies & current period impact

View the full result and save the query here.

Then set up an email alert by navigating to and selecting 10-K/10-Q as your document trigger.

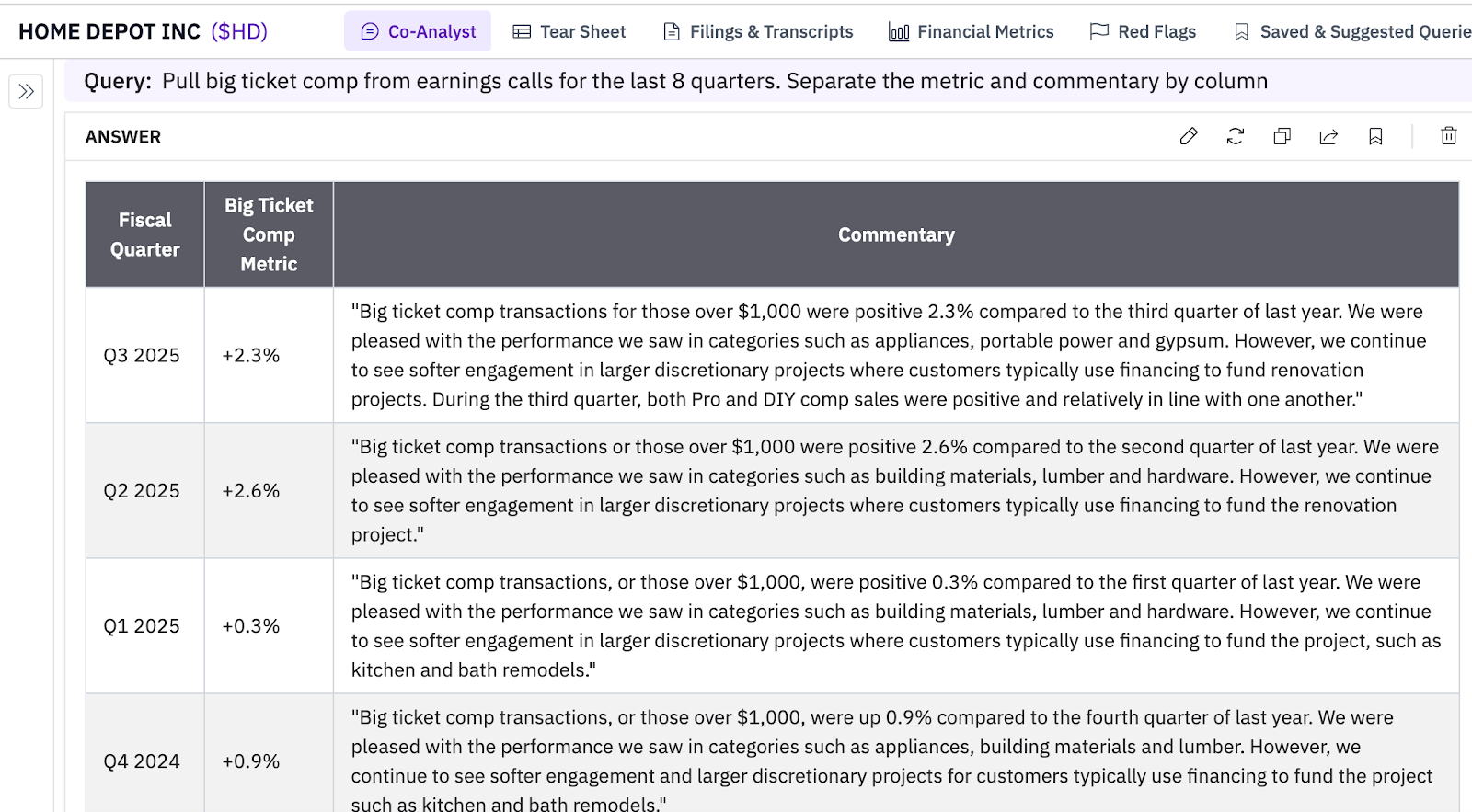

10. From transcript to table in under 20 seconds

Some metrics appear only verbally during earnings or conference calls. AI can locate and extract these figures across multiple quarters — as if they were in a structured table.

Ex: Home Depot – Big ticket comp Transactions

View the full result and re-run the query here.

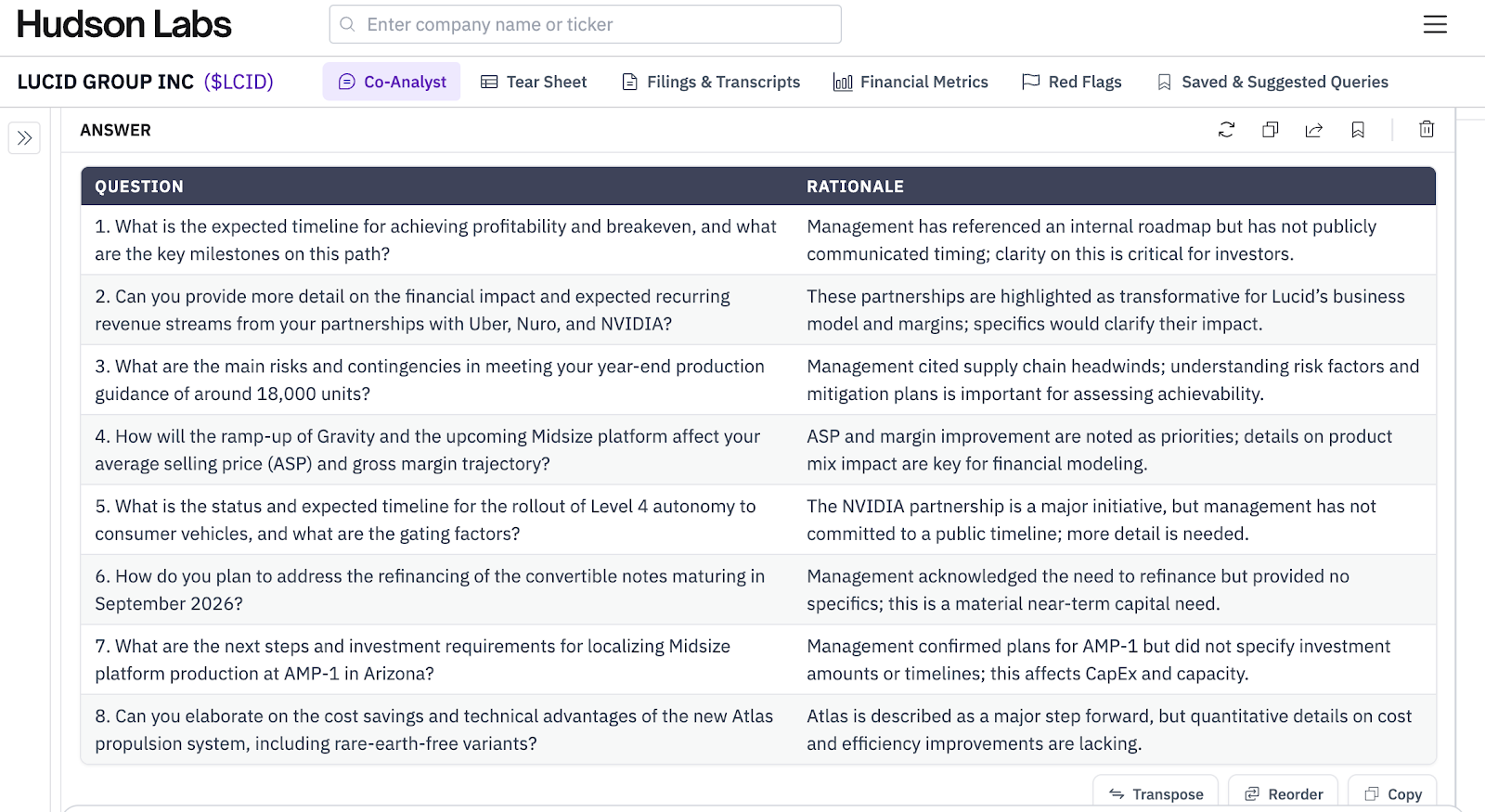

11. What questions should I ask management?

Coming up with intelligent questions that show real business understanding can be one of the hardest parts of the job — especially with limited preparation time. AI incorporates domain knowledge to help craft smart, relevant questions.

Ex 1: Lucid Motors - What 8 questions should I ask the management team?

View the full result and re-run the query here.

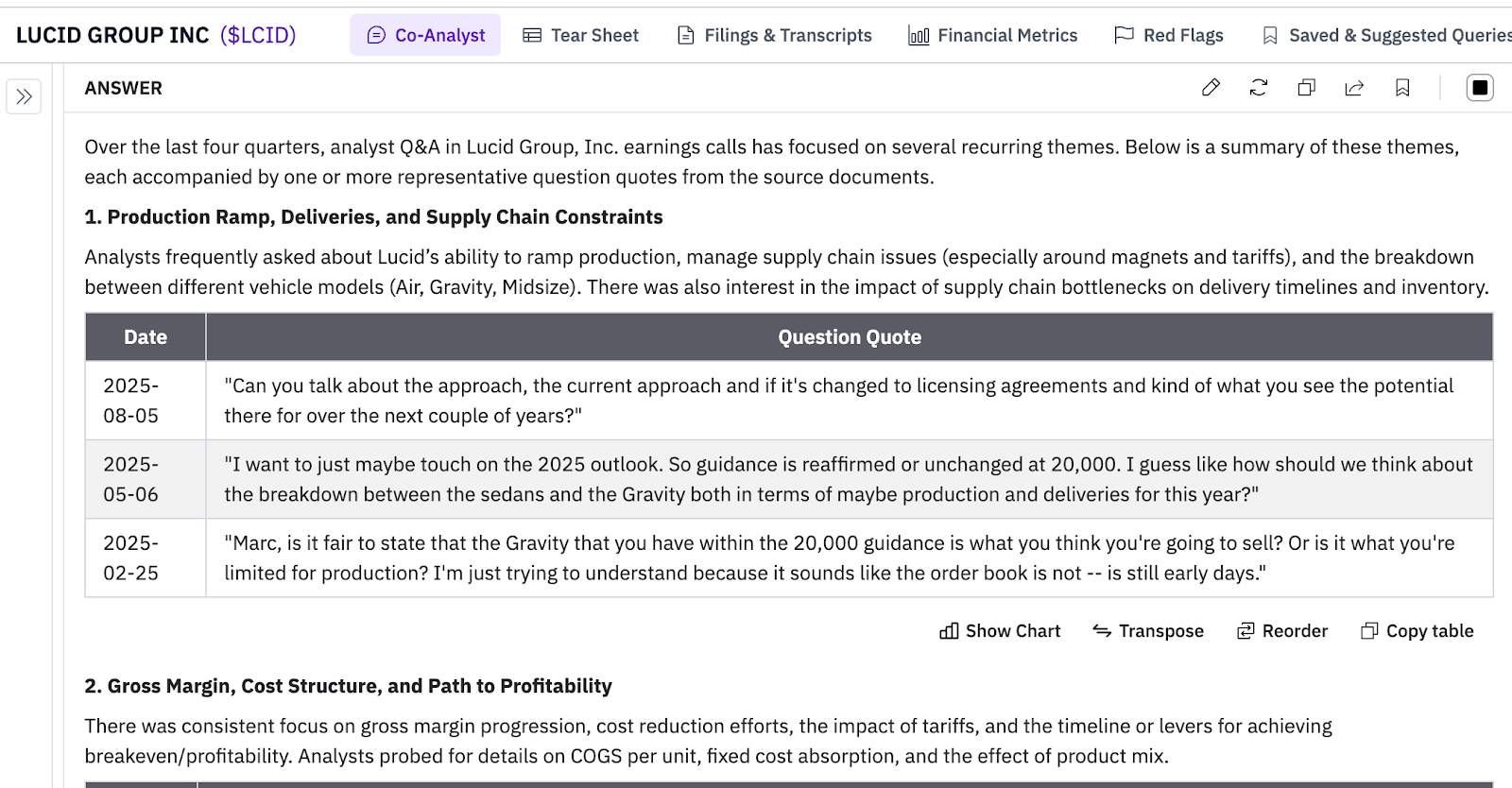

Ex 2: Lucid Motors - Themes of sell-side questions over the last 4 quarters

View the full result and re-run the query here.

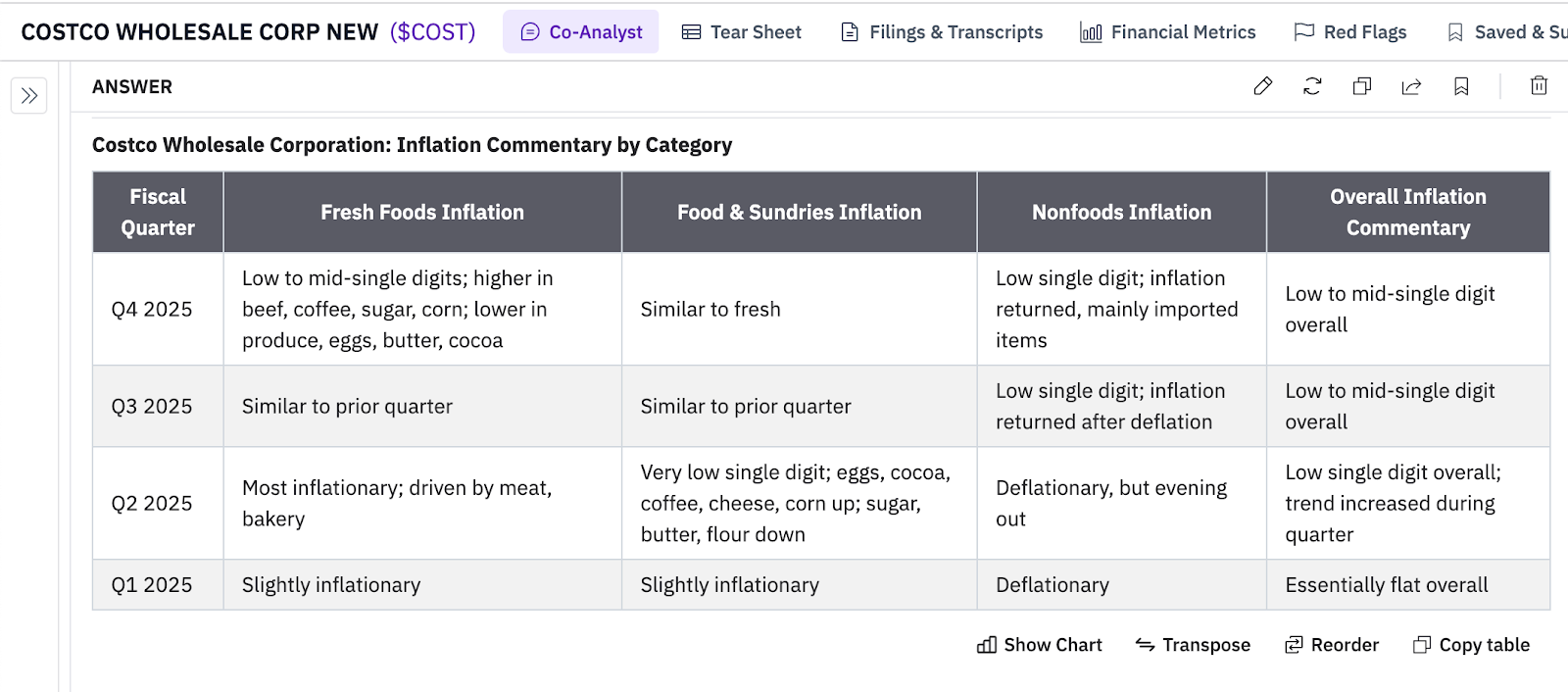

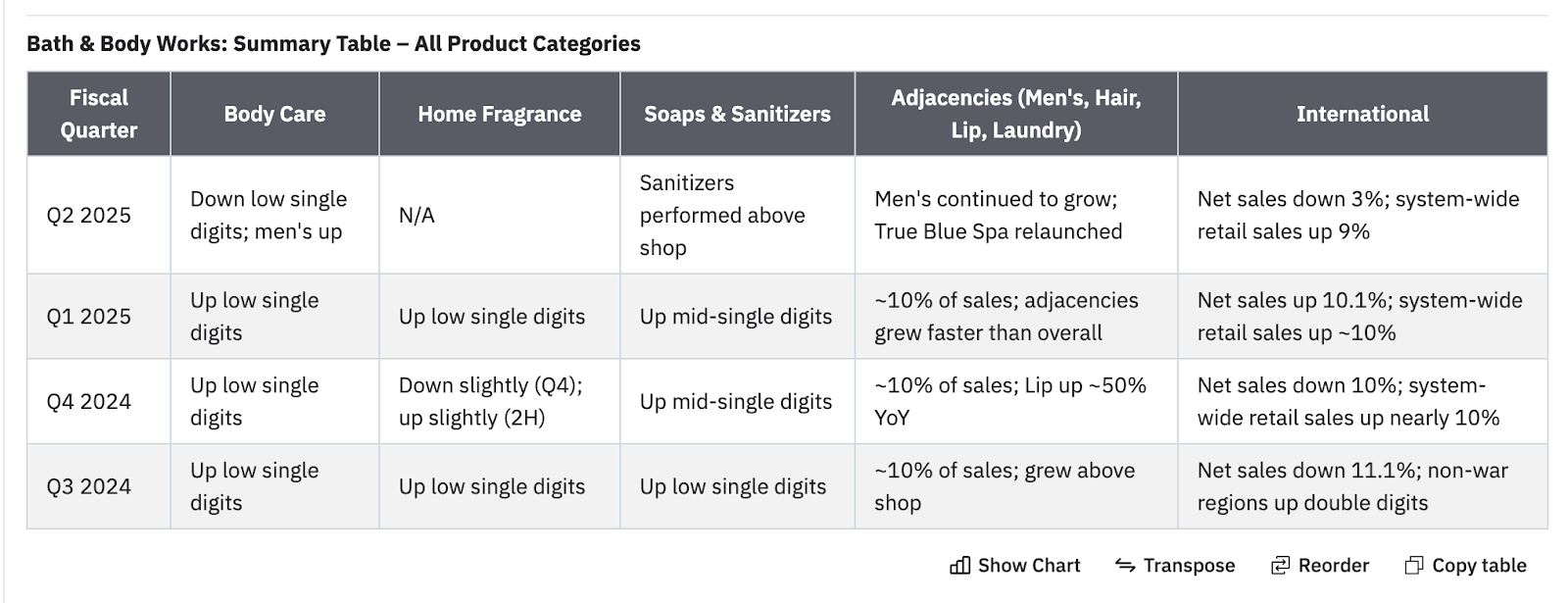

12. Turn "mid single-digits" into a time series dataset

One of the most powerful aspects of AI is its ability to organize information that is not easily accessible in traditional platforms like Bloomberg or FactSet. AI can turn natural language into datasets by tracking semi-qualitative guidance, sentiment, and product-level commentary over time.

Ex 1: Costco – Inflation trends by product

View the full result and re-run the query here.

Ex 2: Bath & Body Works – Product category breakdown

View the full result and re-run the query here.

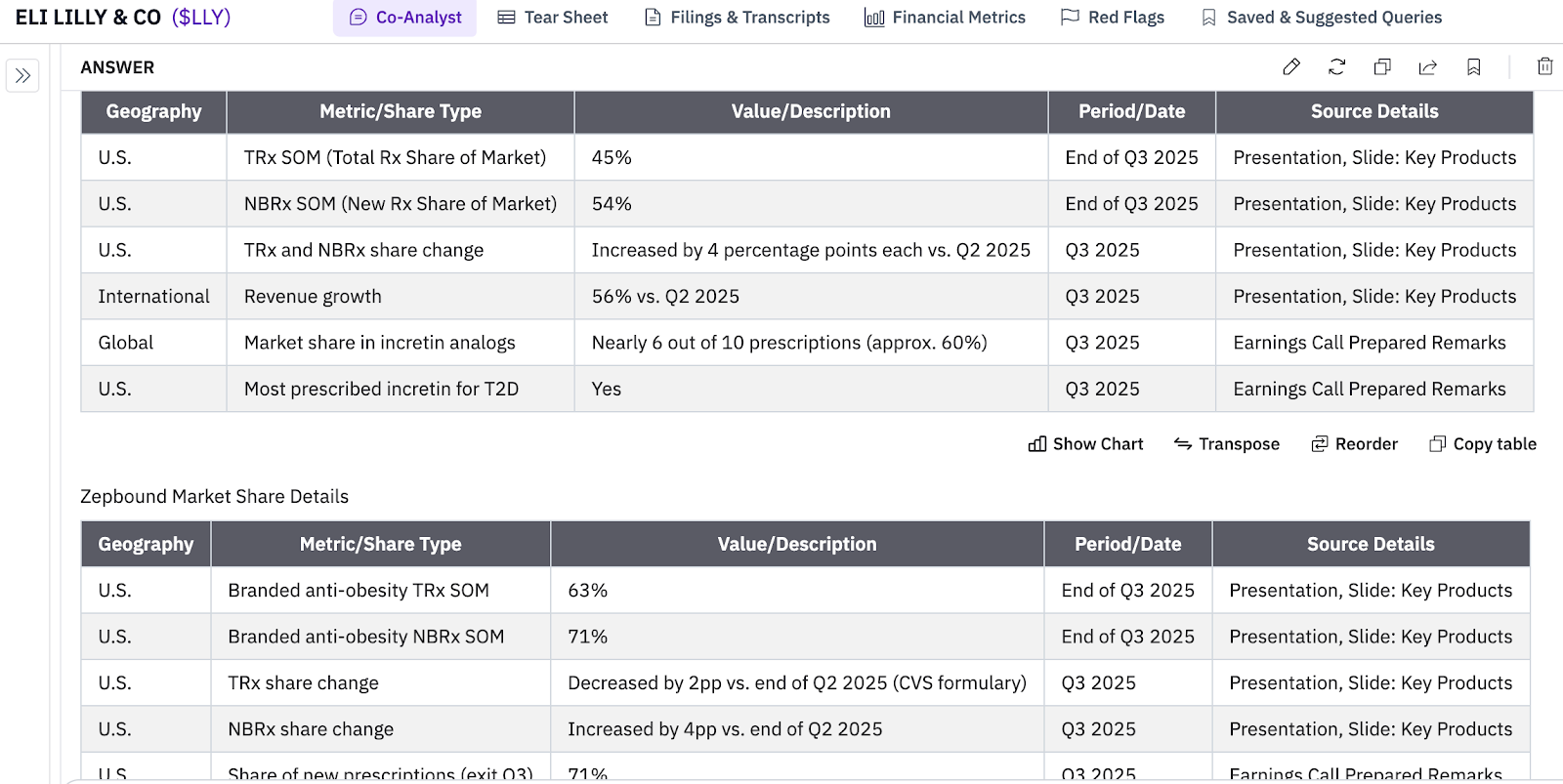

13. Never miss a number hidden in the presentation

It’s easy to miss key details, especially during earnings season. AI can extract and summarize information across all relevant documents — the press release, transcript, presentation, and even the 10-Q.

Ex: Eli Lilly – Incretin market share

Eli Lilly discloses important incretin market-share details in the earnings presentation, but not in the press release. Hudson Labs AI automatically incorporates all relevant documents so you never miss information hiding outside the core release.

View the full result and re-run the query here.

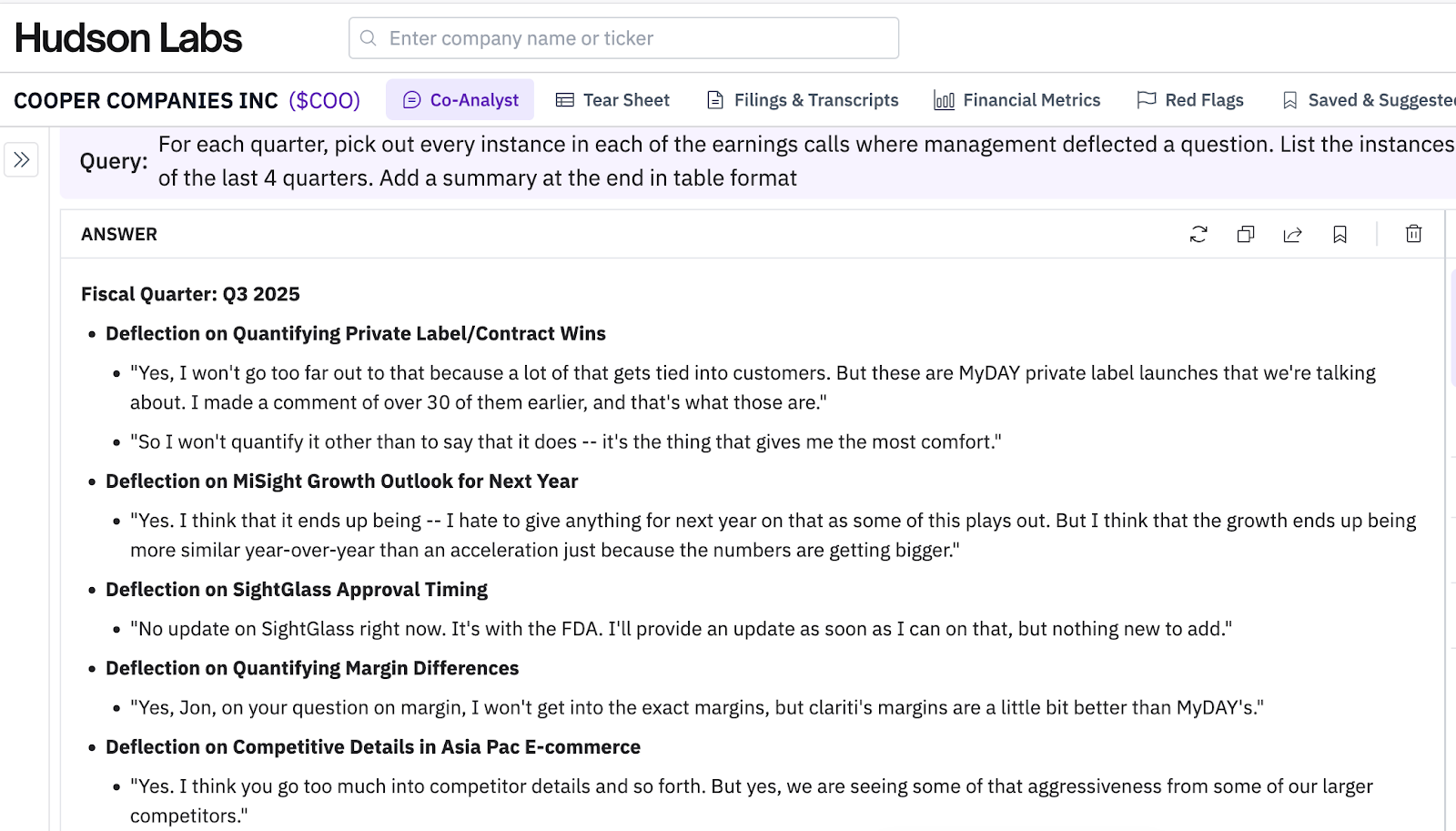

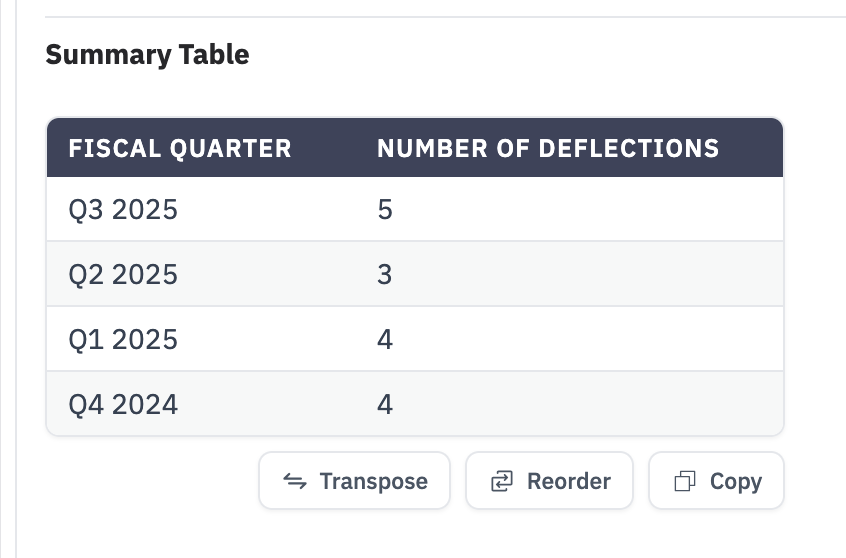

14. Spot executives deflecting hard questions

Executives are generally most straightforward when performance is strong. When answers become vague, evasive, or overly scripted, it can signal pressure beneath the surface.

Hudson Labs AI surfaces instance where management deflects, avoids, or redirects a question — helping you track changes in tone and transparency over time.

Ex: Cooper Companies – Executive deflection patterns across earnings calls

View the full result and re-run the query here.

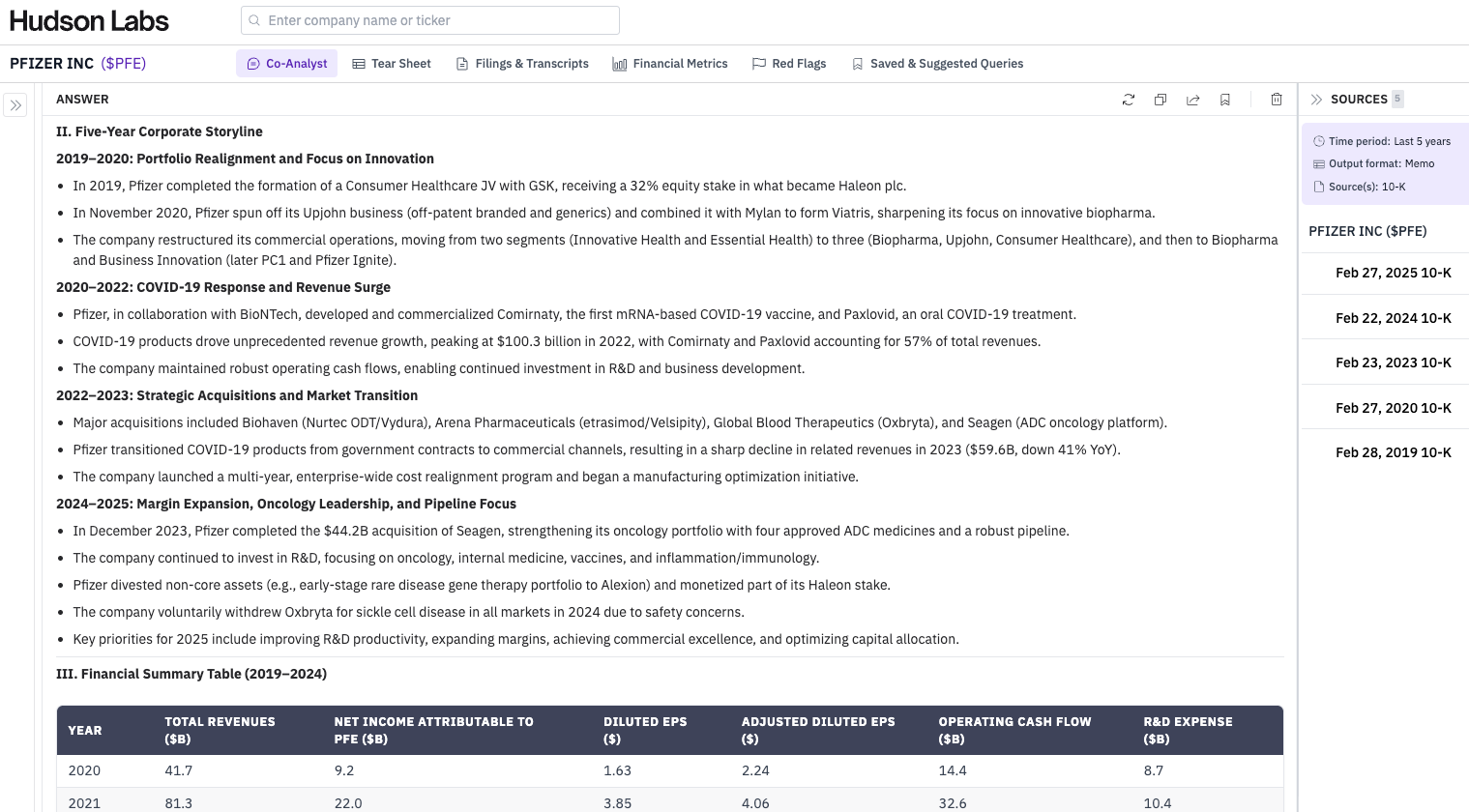

15. Understand the 5-year corporate storyline

"Misunderstanding of the present is the inevitable consequence of ignorance of the past" ~ French historian, Marc Bloch

Getting to know a company requires understanding its history. The current strategy can only be understood in the context of previous successes and blunders.

Generalist AI models struggle with a single long 10-K — let alone five years of filings. Hudson Labs’ multi-year functionality preserves accuracy across deep filing histories, enabling a true five-year corporate narrative.

Ex 1: Pfizer – Strategy evolution across 6 years of 10-Ks

View the full result and re-run the query here.

Sign up to our newsletter to receive 2 examples in your inbox each week.