Rafael Holdings Inc is a real-estate company turned pharma investor. Substantially all of their revenues are from rents on a building and a parking lot in New Jersey, and part of a building in Israel. They have recently sold real-estate and other assets to make a big bet on pharma.

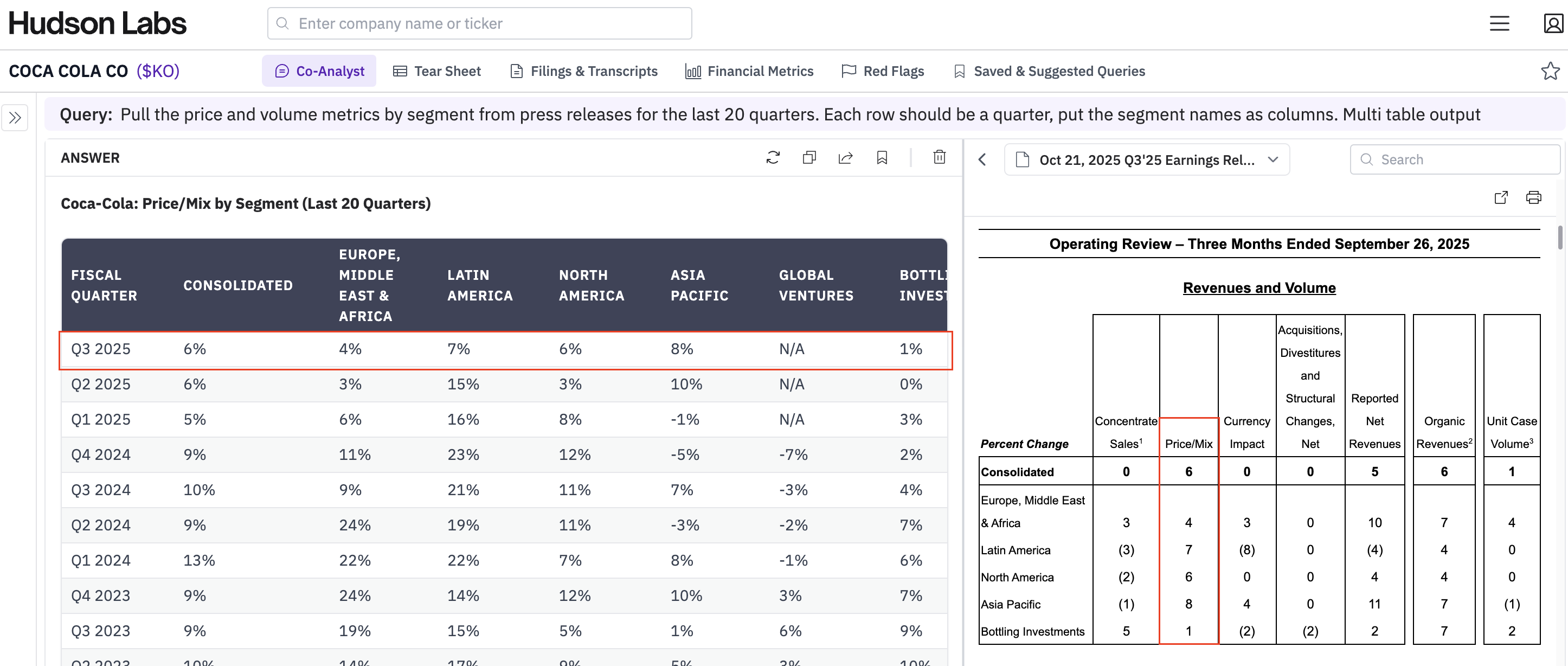

Previously, our algorithms ranked Rafael as having a slightly above average risk score. On October 18, the date they filed their annual report, the Hudson Labs Risk Score jumped to high risk, so we dug a bit deeper.

We flagged Rafael to our institutional clients earlier this week in our Filings of Interest report. Yesterday, their stock price dropped from $30 to $8 when the company filed a press release on the failure of a clinical trial. Ten days earlier, when Rafeal filed their 10-K, our algorithms uncovered disclosures predicting this outcome. The company disclosed that they thought success of the trial was unlikely, just days before the primary trial period was scheduled to end.

If investors had carefully read the 10-K (or subscribed to Hudson Labs' real-time platform) this risk would have been already priced in.

In their 10-K filing summary of key risks, Rafael noted that they were heavily dependent on the success of Rafael Parmaceutical’s CPI-613 product.

“We depend heavily on the future success of Rafael Pharmaceuticals’ lead product candidate (CPI-613® (devimistat)). Clinical trials of the product candidate may not be successful. If Rafael Pharmaceuticals is unable to gain regulatory approval or commercialize its product candidates or experience significant delays in doing so, our business will be materially harmed.”

Companies have to disclose major risks - so disclosing that incomplete trials may not be successful is standard. It is significant that they disclosed that the company depends heavily on its success.

Later in Rafael’s 10-K filing, they indicate that significant milestones (including completing an initial trial of, and filing an application with the FDA for, CPI-613) are not yet considered probable. In particular, the company had signed an agreement that would require them to pay $3M on successful completion of the trial, and another $3M after an FDA application. The company did not record these payments saying they weren't probable. Reading between the lines, they disclosed that they didn’t believe the trial would succeed.

“...3) $3,000,000 due within fifteen (15) days of interim data analysis in Rafael Pharmaceutical’s Phase 3 pivotal trial (AVENGER 500®) of CPI-613® (devimistat); and 4) $3,000,000 which is due within one-hundred and twenty (120) days from the date that Rafael Pharmaceuticals files a new drug application with the U.S. Food and Drug Administration for approval of devimistat (CPI-613) as a first in-line therapy for pancreatic cancer, as defined in the Purchase Agreement.”

“The contingent consideration, as described within the Purchase Agreement, in the amount of $6,000,000, will be recognized when the payments are considered probable.”

Trial details (filed at ClinicalTrials.gov) shows the trial started in November 2018 and was scheduled for ‘primary completion’ in October 2021.

Interesting - just days before the primary completion was scheduled, the company did not believe the trial would succeed.

Yesterday, on October 28, the company filed a press release indicating the trial was not successful. This 10 day delay between their 10-K and their annual report provided a great opportunity for the savvy investor.

Rafael's story highlights why reading the fine print is so critical

When we released our report on $RFL their market cap was over $600M, it’s currently about $140M. Over $400M was lost in one day. Subscribe to Hudson Labs today and never miss another red flag.