“Hello, everyone, and thank you all for joining us today…As a company dedicated to embracing new technology, we are constantly exploring ways to improve our productivity and efficiency. Today, I'm glad to use a trendy AI assistant to walk through my CEO script. The next part of my presentation will be delivered using an AI-generated voice that has been approved by our team and myself…”

Believe it or not, this is a quote from a real earnings call. This is how the CEO of Jianpu Technology (JT), a Chinese financial product recommendation platform, delivered their prepared statements as part of their 2023 Q3 earnings call, thus providing a glimpse into how wholeheartedly the corporate world has embraced AI.

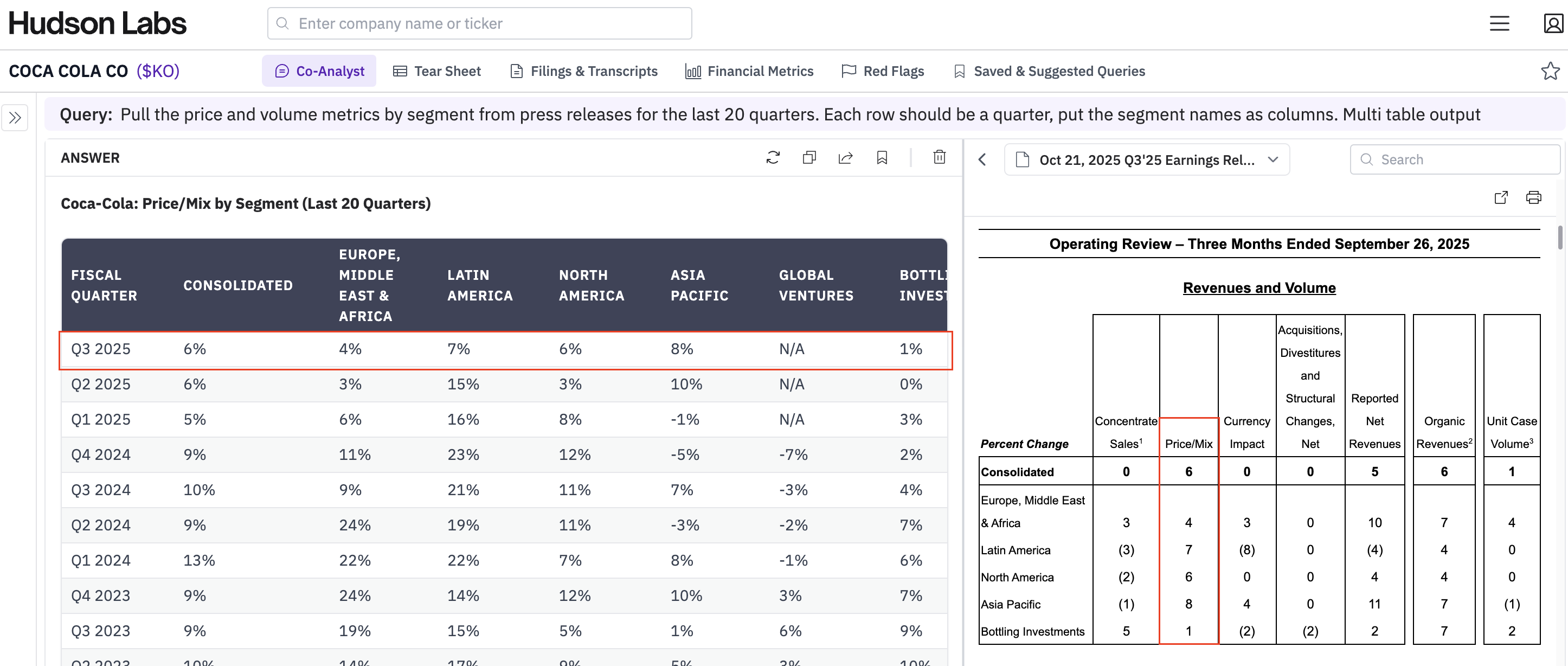

To get a better picture of AI adoption and interest, we analyzed earnings call transcripts of public companies over the past five years.

Interested in exploring which companies embraced artificial intelligence early or late? Explore the complete dataset on the Hudson Labs web platform or make a data request. Book a demo today.

How are AI-related earnings call discussions trending?

We analyzed all earnings calls of over 4,000 US-listed domestic and foreign companies covered by our platform from 2019 onwards. We restricted our analysis to disclosure about AI encompassing machine learning, deep learning, LLMs, vision models, etc. We did not include traditional data analytics or data mining under our purview unless it was mentioned in the context of AI helping accelerate those functions.

Between 2019 and 2023, 1808 out of 4000+ companies’ earnings calls discussed AI in their prepared statements at least once. Unsurprisingly, the number of companies discussing AI during earnings calls saw a sharp rise after the introduction of ChatGPT in November 2022.

In 2019, only 499 companies mentioned AI in their prepared statements compared to 1161 companies in 2023.

And the trend has accelerated in 2024. To include 2024 in the comparison, we limit our analysis to earnings calls in the first two months of each year in the chart below. We see a huge spike in the number of companies with AI-related mentions in 2024. In the first two months, over 500 companies mentioned artificial intelligence in their prepared remarks, almost twice the number of companies that discussed AI in their earnings calls in the first two months of 2023.

And the trend has accelerated in 2024. To include 2024 in the comparison, we limit our analysis to earnings calls in the first two months of each year in the chart below. We see a huge spike in the number of companies with AI-related mentions in 2024. In the first two months, over 500 companies mentioned artificial intelligence in their prepared remarks, almost twice the number of companies that discussed AI in their earnings calls in the first two months of 2023.

For the list of early adopters and AI laggards, make a data request now.

Which companies’ AI strategies garner interest from analysts?

In 2019, analysts asked questions about AI to only 111 companies. Even in 2022, the number was a modest 133. This ballooned to 597 companies for 2023, as you can see in the chart below.

The trend in analyst questions has also accelerated in the first two months of 2024. We found that 225 companies were asked questions regarding artificial intelligence during their earnings calls in the first two months of 2024, compared to 110 companies in the same period last year and only 38 companies in 2022.

Unsurprisingly, most AI-related analyst questions were posed to tech companies. However, non-tech companies were also asked their fair share of AI-related questions, some more than others.

Companies in the Surgical & Medical Instruments & Apparatus industry had the most AI-related analyst questions (56) between 2019 and 2024, with Management Consulting and REITs sharing the second spot with 53 questions each. Here are the top 10 non-tech industries that received the most number of AI-related analyst questions between 2019 and 2024:

Drilling down to the company level, here are the top ten non-tech companies with the most AI-related questions between 2019 and 2024. Coincidently, the top two companies on the list, iCAD (ICAD) and Radnet (RDNT), are both using AI for cancer detection.

How does AI compare to other recent hot topics?

It's undeniable that AI is already being adopted by many public companies and is making significant impacts on business operations and efficiency. Comparing AI to other recent hot topics, it’s clear that the excitement around AI far exceeds the level of enthusiasm we saw for crypto and Web3 among public companies and their analysts. Between 2019 and 2024, Web3 was discussed in only 85 companies, and crypto in 313 companies, compared to a whopping 2312 companies and counting for AI. The trend is only accelerating as the charts above show. Recent spikes in the prices of various cryptocurrencies notwithstanding, Web3 and crypto mentions in earnings calls peaked in 2022.

Here at Hudson Labs, we are passionate about AI advancement and research. We will continue to monitor and report on AI adoption trends over time.

Interested in the underlying data used for insights here or want to request a custom data pull? The full data pull is available to premium (tier 2+) Hudson Labs customers. Learn more here on how to make a data pull request.